Value-at-Risk Estimation: A Copula-GARCH Approach

Author

Term

4. term

Education

Publication year

2023

Submitted on

2023-06-01

Pages

79

Abstract

Specialet indeholder en analyse af Value-at-Risk af en portefølje indeholdende de 10 største aktier fra S&P500 indekset. Porteføljen er konstrueret som en copula-GARCH model og risikoen er evalueret baseret på Monte Carlo estimation. Derudover er der lavet en sammenligning med den parametriske Value-at-Risk af S&P500 indekset.

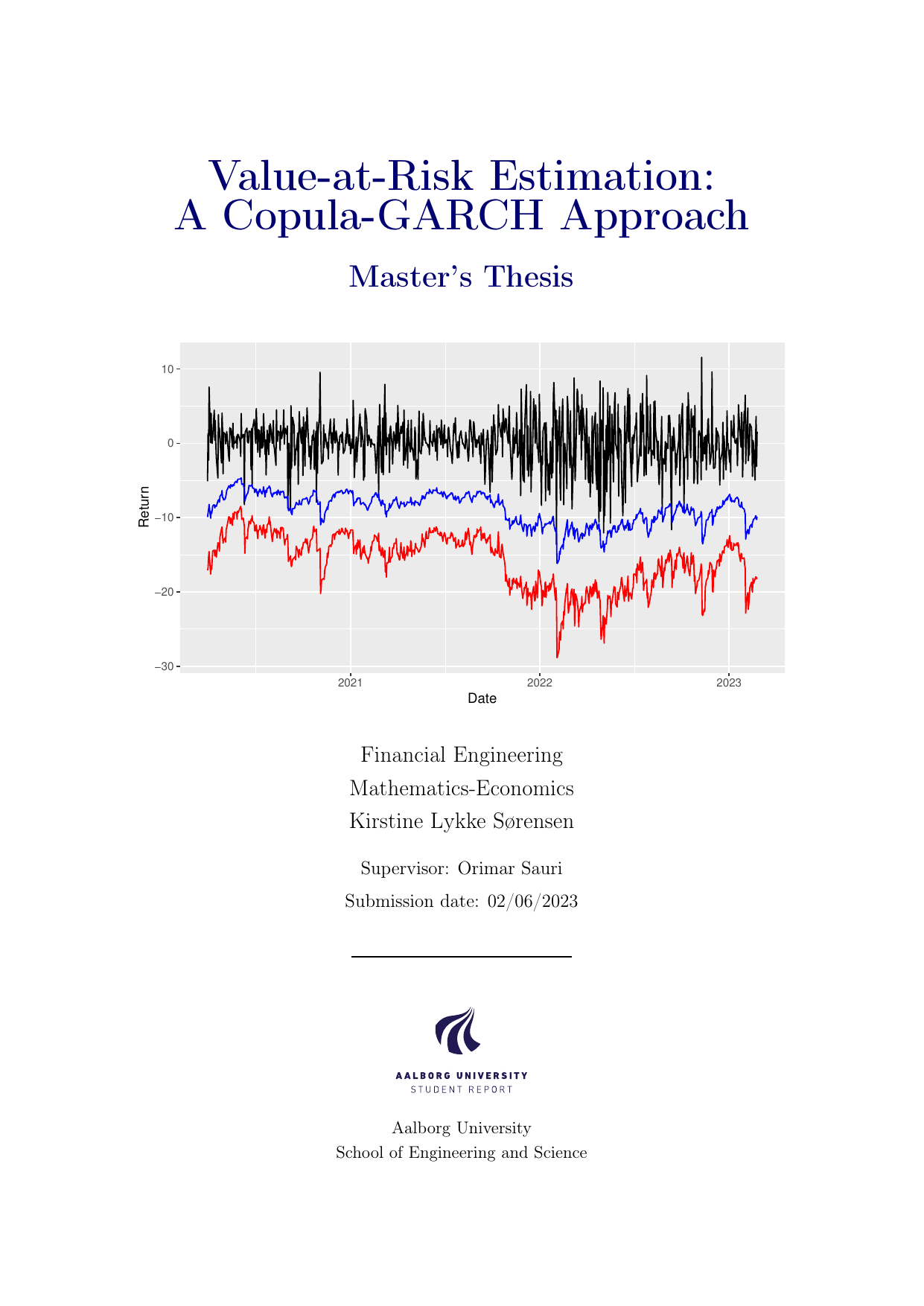

The thesis contains an analysis of the Value-at-Risk of a portfolio consisting of the 10 largest assets of the S&P500 index. The portfolio is constructed as a copula-GARCH model and the risk is evaluated based on Monte Carlo estimations. Moreover, a comparison is made with the parametric Value-at-Risk of the S&P500 Index.

Keywords

copula ; ARMA-GARCH ; Value-at-Risk ; S&P500

Documents